Compare Arizona health insurance coverage from all companies and instantly enroll in a plan. Affordable medical benefits are offered to individuals, families, the uninsured, and persons eligible for Medicare or Medicaid. Free online quotes allow you to easily view and compare rates, office visit, ER, and Urgent Care copays, along with low hospitalization out-of-pocket costs. Short-term gap plans are available, and provide very inexpensive costs for applicants that need coverage 12 months or less.

Blue Cross Blue Shield of Arizona and many other carriers offer affordable options for your Obamacare Marketplace coverage (with or without a federal subsidy), and Senior Medicare Supplement, Medicare Advantage (MA) and Part D prescription drug plans. Open Enrollment periods are October 15th and December 7th for Seniors, and November 1st and January 15th for applicants under age 65. During the OE period, no medical questions are asked, and pre-existing conditions are covered for newly-issued plans.

Currently, the eight carriers offering Marketplace plans in The Grand Canyon State are Banner/Aetna CVS Health, Medica Community Health Plan, Blue Cross Blue Shield Of Arizona, Health Net Of Arizona, UnitedHealthcare, Imperial, Oscar, and Cigna. Banner/Aetna CVS Health offers Exchange plans in Pima, Pinal, and Maricopa Counties. Carriers that no longer offer ACA Obamacare plans include Humana, Phoenix Health Plans, and Health Choice. Bright Health exited the state as of December 31st.

2024 Non-compliant temporary plans are also offered with initial 364-day durations, and up to three years in renewals. Essential health benefits are not required to be included, and generally, pre-existing conditions are not covered. However, these options are ideal for persons that missed an Open Enrollment deadline or prefer the cheapest available catastrophic plan without a federal subsidy. The AZ Department of Insurance regulates all plans. Last year, more than 199,000 applicants enrolled in a plan.

2024 Average Rate Change Requests For Arizona Marketplace Plans

Banner Health and Aetna Health – 2.02% increase

BCBS Of Arizona – 4.54% decrease

Health Net Of Arizona – 2.42% increase

Imperial Insurance Companies – 8.04% decrease

Medica Community Health Plan – 7.17% increase

Oscar Health Plan – 1.04% decrease

UnitedHealthcare – 1.20% decrease

Arizona Private Marketplace Health Insurance Plans

Catastrophic Tier

Oscar Secure – First three pcp office visits fully covered. $9,450 deductible and 0% coinsurance with maximum out-of-pocket expenses of $9,450.

Bronze Tier

Ambetter Standard Expanded Bronze Select – $7,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,400. $50 and $100 office visit copays and $75 Urgent Care copay. $25 generic drug copay ($37.50 mail order).

Ambetter Standard Expanded Bronze – $7,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,400. $50 and $100 office visit copays and $75 Urgent Care copay. $25 generic drug copay ($37.50 mail order).

Ambetter Standard Everyday Bronze – $8,450 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,250. $40 and $90 office visit copays and $50 Urgent Care copay. $3/$30 preferred generic and generic drug copays ($7.50 and $75 Mail order). $50 copay for lab tests.

Ambetter Choice Bronze HSA – $7,250 deductible and 0% coinsurance with maximum out-of-pocket expenses of $7,250. HSA-eligible.

Ambetter Elite Bronze – $0 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,250. $45 and $115 office visit copays and $60 Urgent Care copay. $3/$35 preferred generic and generic drug copays ($7.50 and $87.50 Mail order). $60 copay for lab tests.

Banner Aetna Bronze S – $7,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,400. $50 and $100 office visit copays. Preferred and non-preferred generic drug copay is $25 ($62.50 mail order). $75 Urgent Care copay.

Banner Aetna Bronze 2 HSA – $6,200 deductible and 50% coinsurance with maximum out-of-pocket expenses of $7,500. $25 preferred generic drug copay ($62.50 mail order). HSA-eligible.

Banner Aetna Bronze 4 – $0 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,400. $50 and $100 office visit copays. Preferred and non-preferred generic drug copay is $5 and $40 ($12.50 and $100 mail order). $50 Urgent Care copay. Lab test and x-ray copays are $50 and $75.

Banner Aetna HMO ON Standard – $7,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,000. $50 and $100 office visit copays and $75 Urgent Care copay. $25 preferred/ non-preferred generic drug copays ( $62.50 Mail order). $60 copay for lab tests.

BCBS Blue AdvanceHealth Bronze – First four pcp office visits fully covered. $9,000 deductible and 0% coinsurance with maximum out-of-pocket expenses of $9,000. $0 and $20 copays for Tier 1a and Tier 1b drugs.

BCBS Blue EveryDayHealth Bronze – $95 and $150 office visit copays (first two pcp visits covered with $0 copay). $8,000 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,300. $3 and $20 copays for Tier 1a and Tier 1b drugs. $115 Urgent Care copay.

BCBS Blue Standard Health Bronze – $50 and $100 office visit copays. $7,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,400. $25 generic drug copay. Tiers 2 and 3 drug copays are $50 and $100 (after deductible).$75 Urgent Care copay.

BCBS Blue Portfolio HSA Bronze – $7,050 deductible and 0% coinsurance with maximum out-of-pocket expenses of $7,050. HSA-eligible.

Cigna Simple Choice 9100 – $9,100 deductible and 0% coinsurance with maximum out-of-pocket expenses of $9,100.

Cigna Connect 8700 – $8,700 deductible and 0% coinsurance with maximum out-of-pocket expenses of $8,700.

Cigna Connect 7000 – $60 and $90 office visit copays. $7,000 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,100. $75 Urgent Care copay and $3 preferred generic drug copay ($7.50 mail order).

Cigna Connect HSA 7050 – $7,000 deductible and 0% coinsurance with maximum out-of-pocket expenses of $7,000. HSA-eligible.

Cigna Connect 6800 Enhanced Diabetes Care – $50 and $90 office visit copays. $6,800 deductible and 40% coinsurance with maximum out-of-pocket expenses of $9,100. $75 Urgent Care copay and $3 and $30 preferred generic and generic drug copays ($7.50 and $90 mail order).

Medica Pinnacle Bronze Standard – $9,100 deductible and 0% coinsurance with maximum out-of-pocket expenses of $9,100.

Medica Pinnacle Bronze Copay – $40 and $120 office visit copays. $7,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,100. $40 Urgent Care copay and $25 and $165 generic and brand drug copays.

Medica Pinnacle Bronze Copay $0 PCP – $0 and $150 office visit copays. $7,200 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,100. $0 Urgent Care copay and $25 and $200 preferred generic and preferred brand drug copays.

Medica Pinnacle Bronze Share Plus – $2,700 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,100. $40 Preferred generic, generic, and preferred brand drug copays are $20, $30, and $200.

Medica Pinnacle Bronze HSA – $5,700 deductible and 20% coinsurance with maximum out-of-pocket expenses of $7,500. HSA-eligible.

Oscar Bronze Simple Standard – $9,100 deductible and 0% coinsurance with maximum out-of-pocket expenses of $9,100.

Oscar Bronze Classic – $7,750 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,100. $75 Urgent Care copay and $3 and $30 Tier 1A and Tier 1B drug copays. $250 preferred brand drug copay.

Oscar Bronze Classic – PCP Saver – $50 pcp office visit copay. $7,750 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,100. $75 Urgent Care copay and $3 and $30 Tier 1A and Tier 1B drug copays. $250 preferred brand drug copay.

Oscar Bronze Simple HSA Plan – $5,200 deductible and 50% coinsurance with maximum out-of-pocket expenses of $7,450. $75 Urgent Care copay and $3 and $25 Tier 1A and Tier 1B drug copays. $200 preferred brand drug copay. Deductible applies to prescriptions. $50 and $90 office visit copays subject to deductible.

Oscar Bronze Elite – $60 and $125 office visit copays. $0 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,000. $75 Urgent Care copay and $3 and $30 Tier 1A and Tier 1B drug copays. $50 and $125 preferred brand drug copays. $125 and $25 copays for x-rays and lab work.

UnitedHealthcare Bronze Essential+ – $9,100 deductible and 0% coinsurance with maximum out-of-pocket expenses of $9,100. $3 Tier 1 drug copay.

UnitedHealthcare Bronze Standard $9,100 Deductible – $9,100 deductible and 0% coinsurance with maximum out-of-pocket expenses of $9,100. $3 Tier 1 drug copay.

UnitedHealthcare Bronze $7,500 Deductible 2 – $7,500 deductible and 30% coinsurance with maximum out-of-pocket expenses of $9,100. $0 pcp office visit copay and $3 and $20 Tier 1 and $30 Tier 2 drug copays. $75 Urgent Care copay (deductible also applies). Lab test copays are $30 (free standing/office) and $75 (hospital).

UnitedHealthcare Bronze Value HSA – $6,700 deductible and 30% coinsurance with maximum out-of-pocket expenses of $7,500. HSA-eligible.

UnitedHealthcare Bronze Value $7,500 Deductible – $7,500 deductible and 40% coinsurance with maximum out-of-pocket expenses of $9,100. $0 pcp office visit copay and $3 and $20 Tier 1 and $30 Tier 2 drug copays. $75 Urgent Care copay (deductible also applies). Lab test copays are $30 (free standing/office) and $75 (hospital).

UnitedHealthcare Bronze Standard $7,500 Deductible – $7,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $9,000. $50 and $100 office visit copays. $25 and $50 office visit copays. $75 Urgent Care copay (deductible also applies).

Silver Tier

Ambetter Balanced Care 31 – $5,450 deductible and 10% coinsurance with maximum out-of-pocket expenses of $6,450. $60 Urgent Care copay.

Ambetter Balanced Care 30 – $6,100 deductible and 0% coinsurance with maximum out-of-pocket expenses of $6,100.

Ambetter Balanced Care 32 – $45 and $100 office visit copays. $8,100 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. $60 Urgent Care copay. $5 and $25 preferred generic and generic drug copays. $75 preferred brand drug copay. $50 copay for diagnostic tests.

Ambetter Balanced Care 29 – $25 and $95 office visit copays. $5,450 deductible and 35% coinsurance with maximum out-of-pocket expenses of $8,650. $60 Urgent Care copay. $5 and $25 preferred generic and generic drug copays. $75 preferred brand drug copay. $40 copay for diagnostic tests.

Ambetter Balanced Care 12 – $35 and $70 office visit copays. $6,500 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,400. $55 Urgent Care copay. $5 and $25 preferred generic and generic drug copays. $60 preferred brand drug copay. $35 copay for diagnostic tests.

Ambetter Balanced Care 11 – $30 and $60 office visit copays. $6,000 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,500. $60 Urgent Care copay. $5 and $20 preferred generic and generic drug copays. $55 preferred brand drug copay. $30 copay for diagnostic tests.

Ambetter Balanced Care 4 – $30 and $60 office visit copays. $7,200 deductible and 0% coinsurance with maximum out-of-pocket expenses of $7,200. $60 Urgent Care copay. $5 and $15 preferred generic and generic drug copays. $50 preferred brand drug copay. $30 copay for diagnostic tests.

Ambetter Balanced Care 28 – $50 and $90 office visit copays. $0 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,200. $60 Urgent Care copay. $5 and $30 preferred generic and generic drug copays. $50 copay for diagnostic tests.

Banner Aetna Silver $25 copay 6000 – $25 and $75 office visit copays. $6,000 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $75 Urgent Care copay. $10 and $50 preferred generic and preferred brand drug copays ($25 and $125 mail order).

Banner Aetna Silver $20 copay 4000 – $20 and $75 office visit copays. $4,000 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $75 Urgent Care copay. $10 and $50 preferred generic and preferred brand drug copays ($25 and $125 mail order). $50 copay for diagnostic tests.

BCBS Blue AdvanceHealth Silver – $0 for first four pcp office visits. $8,000 deductible and 0% coinsurance with maximum out-of-pocket expenses of $8,000. $0 and $5 copays for Tier 1a and Tier 1b drugs.

BCBS Blue EverydayHealth Silver – $20 and $75 office visit copays. $0 for first two pcp office visits. $4,750 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,000. $3 and $15 copays for Tier 1a and Tier 1b drugs.

BCBS Blue TrueHealth Silver – $0 and $95 office visit copays. $6,750 deductible with maximum out-of-pocket expenses of $8,700. $3 and $10 copays for Tier 1a and Tier 1b drugs. $150 Tier 2 drug copay. $100 Urgent Care copay.

BCBS Blue PPO Silver – $15 and $75 office visit copays. $0 for first two pcp office visits. $3,100 deductible and 20% coinsurance with maximum out-of-pocket expenses of $8,700. $3 and $15 copays for Tier 1a and Tier 1b drugs.

Bright Health Silver 4000 – $35 pcp office visit copay. $4,000 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $50 Urgent Care copay and $15 preferred generic drug copay.

Bright Health Silver 3000 – $35 and $70 office visit copays. $0 for first two pcp office visits. $3,000 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $50 Urgent Care copay and $0/$30 preferred generic drug copays. Preferred brand and non-preferred generic drug copays are $150, and $50 and $100 lab and x-ray copays.

Bright Health Silver 6700 – $0 and $75 office visit copays. $0 for first two specialist office visits. $6,700 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $50 Urgent Care copay and $0/$90 preferred generic drug copays. Preferred brand and non-preferred generic drug copays are $150, and $50 and $100 lab and x-ray copays.

Bright Health Silver 3000 – $30 office visit copays. $0 for first two pcp office visits. $0 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $50 Urgent Care copay and $0/$30 preferred generic drug copays. Preferred brand and non-preferred generic drug copays are $150, and $50 and $100 lab and x-ray copays. $200 imaging copay.

Cigna Connect 5500 – $20 and $75 office visit copays. $5,500 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. $35 Urgent Care copay. Preferred generic and generic drug copays are $3 and $20 ($7.50 and $50 mail order).

Cigna Connect 5000 – $20 and $80 office visit copays. $5,000 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. $35 Urgent Care copay. Preferred generic and generic drug copays are $0 and $30 ($0 and $75 mail order). Preferred brand drug copay is $80 ($240 mail order).

Cigna Connect 4200 – $15 and $75 office visit copays. $4,200 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $35 Urgent Care copay. Preferred generic and generic drug copays are $3 and $20 ($7.50 and $50 mail order). Preferred brand drug copay is $70 ($210 mail order).

Cigna Connect 4200 – $15 and $75 office visit copays. $4,200 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $35 Urgent Care copay. Preferred generic and generic drug copays are $0 and $30 ($0 and $75 mail order). Preferred brand drug copay is $80 ($240 mail order).

Cigna Connect 4000 – $15 and $75 office visit copays. $4,200 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $35 Urgent Care copay. Preferred generic and generic drug copays are $0 and $30 ($0 and $75 mail order). Preferred brand drug copay is $80 ($240 mail order).

Cigna Connect 3500 – $10 and $80 office visit copays. $3,500 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $35 Urgent Care copay. Preferred generic and generic drug copays are $3 and $20 ($7.50 and $50 mail order). Preferred brand drug copay is $70 ($210 mail order).

Medica Pinnacle Silver Copay – $25 and $110 office visit copays. $6,500 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,700. $25 Urgent Care copay. Generic and preferred brand drug copays are $10 and $120.

Medica Silver Pinnacle Silver Share – $2,700 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. Generic and preferred brand drug copays are $10 and $120.

Oscar Silver Simple – PCP Saver Plan – $20 pcp office visit copay. $5,000 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,375. $75 Urgent Care copay and $3 and $20 Tier 1A and Tier 1B drug copays. $250 preferred brand drug copay. $10 copay for lab work.

Oscar Silver Simple – $25 and $90 office visit copays. $4,200 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. $75 Urgent Care copay and $3 and $20 Tier 1A and Tier 1B drug copays. $60 and $150 preferred brand drug copays. $10 copay for lab work. $50 copay for x-rays.

Oscar Silver Simple – Specialist Saver Plan – $40 office visit copays. $6,450 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. $75 Urgent Care copay and $3 and $25 Tier 1A and Tier 1B drug copays. $75 and $187.50 preferred brand drug copays. $10 copay for lab work. $65 copay for x-rays.

Oscar Silver Simple – High Ded Plan – $7,800 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,000. $75 Urgent Care copay and $3 and $10 Tier 1A and Tier 1B drug copays. $10 copay for lab work. HSA-eligible.

Oscar Silver Simple – HSA Plan – $4,500 deductible and 0% coinsurance with maximum out-of-pocket expenses of $4,500. HSA-eligible.

Oscar Silver Classic Plan – $35 and $95 office visit copays. $5,750 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. $50 Urgent Care copay and $3 and $25 Tier 1A and Tier 1B drug copays. $100 and $250 preferred brand drug copays. $10 copay for lab work. $95 copay for x-rays.

Oscar Silver Classic – Low Ded Plan – $65 and $95 office visit copays. $1,500 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,000. $75 Urgent Care copay and $3 and $25 Tier 1A and Tier 1B drug copays. $100 and $250 preferred brand drug copays. $10 copay for lab work. $75 copay for x-rays.

Oscar Silver Elite – $0 Ded Plan – $40 and $100 office visit copays. $0 deductible and 50% coinsurance with maximum out-of-pocket expenses of $8,700. $50 Urgent Care copay and $3 and $30 Tier 1A and Tier 1B drug copays. $150 and $375 preferred brand drug copays. $10 copay for lab work. $95 copay for x-rays.

UnitedHealthcare Silver Value+ – $25 and $100 office visit copays. $6,300 deductible and 30% coinsurance with maximum out-of-pocket expenses of $8,700. $75 Urgent Care copay and $3 and $25 Tier 1 and Tier 2 drug copays. $85 Tier 3 drug copay. $50 copay for lab work.

UnitedHealthcare Silver Advantage+ – $45 (first three visits $0 copay) and $75 office visit copays. $4,500 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,000. $50 Urgent Care copay and $3 and $25 Tier 1 and Tier 2 drug copays. $85 Tier 3 drug copay. $25 copay for lab work. $65 copay for x-rays.

UnitedHealthcare Silver Value+ Base – $25 (first three visits $0 copay) pcp office visit copay. $5,000 deductible and 30% coinsurance with maximum out-of-pocket expenses of $8,000. $75 Urgent Care copay and $3 and $25 Tier 1 and Tier 2 drug copays. $85 Tier 3 drug copay.

UnitedHealthcare Silver Value+ Saver – $25 (first three visits $0 copay) pcp office visit copay. $4,500 deductible and 30% coinsurance with maximum out-of-pocket expenses of $8,700. $75 Urgent Care copay and $3 and $25 Tier 1 and Tier 2 drug copays. $85 Tier 3 drug copay.

UnitedHealthcare Silver Advantage+ Extra – $45 (first three visits $0 copay) and $75 office visit copays. $3,000 deductible and 40% coinsurance with maximum out-of-pocket expenses of $8,000. $50 Urgent Care copay and $3 and $25 Tier 1 and Tier 2 drug copays. $85 Tier 3 drug copay. $25 copay for lab work. $65 copay for x-rays.

Gold Tier

Ambetter Secure Care 20 – $35 and $55 office visit copays. $750 deductible and 35% coinsurance with maximum out-of-pocket expenses of $7,500. $35 Urgent Care copay. $5 and $15 preferred generic and generic drug copays. $60 preferred brand drug copay. $35 copay for diagnostic tests.

Ambetter Secure Care 5 – $15 and $35 office visit copays. $1,450 deductible and 20% coinsurance with maximum out-of-pocket expenses of $6,300. $35 Urgent Care copay. $5 and $15 preferred generic and generic drug copays. $30 preferred brand drug copay. $15 copay for lab tests.

Banner Aetna Gold $15 copay 1450 – $15 and $35 office visit copays. $1,450 deductible and 20% coinsurance with maximum out-of-pocket expenses of $8,700. $35 Urgent Care copay. $15 and $40 preferred generic and preferred brand drug copays ($37.50 and $100 mail order).

BCBS AdvanceHealth Gold – $15 and $50 office visit copays (no charge for first four pcp office visits). $2,000 deductible and 50% coinsurance with maximum out-of-pocket expenses of $7,250. $3 and $15 copays for Tier 1a and Tier 1b drugs. $70 copay for Tier 2 drugs.

BCBS EverydayHealth Gold – $15 and $50 office visit copays (no charge for first two pcp office visits). $2,000 deductible and 50% coinsurance with maximum out-of-pocket expenses of $7,250. $3 and $15 copays for Tier 1a and Tier 1b drugs. $70 copay for Tier 2 drugs.

Bright Health Gold 1000 – $0 and $40 office visit copays (no charge for first two specialist office visits). $1,000 deductible and 20% coinsurance with maximum out-of-pocket expenses of $8,700. $0 and $15 preferred generic drug copays. $50 copay for preferred brand and non-preferred generic drugs. Non-preferred brand drug copay is $125. X-ray and blood work copays are $50 and $100. $50 Urgent Care copay.

Bright Health Gold $0 Deductible – $20 and $40 office visit copays (no charge for first two pcp office visits). $0 deductible and 20% coinsurance with maximum out-of-pocket expenses of $6,500. $0 and $15 preferred generic drug copays. $50 copay for preferred brand and non-preferred generic drugs. Non-preferred brand drug copay is $125. X-ray and blood work copays are $50 and $100. $50 Urgent Care copay.

Cigna Connect 1250 – $10 and $50 office visit copays. $1,250 deductible and 20% coinsurance with maximum out-of-pocket expenses of $7,500. $30 Urgent Care copay. Preferred generic and generic drug copays are $2 and $10 ($5 and $25 mail order). Preferred brand drug copay is $50 ($150 mail order).

Medica Pinnacle Gold Copay – $20 and $75 office visit copays. $1,250 deductible and 30% coinsurance with maximum out-of-pocket expenses of $8,450. $20 Urgent Care copay. Generic and preferred brand drug copays are $5 and $80.

Medica Pinnacle Gold Share – $700 deductible and 30% coinsurance with maximum out-of-pocket expenses of $8,450. Generic and preferred brand drug copays are $5 and $80.

Oscar Gold Classic – $40 office visit copays. $3,500 deductible and 30% coinsurance with maximum out-of-pocket expenses of $6,000. $50 Urgent Care copay and $3 and $20 Tier 1A and Tier 1B drug copays. $75 and $187.50 preferred brand drug copays. $10 copay for lab work. $75 copay for x-rays. $375 imaging copay.

Oscar Gold Elite – $25 and $50 office visit copays. $500 deductible and 30% coinsurance with maximum out-of-pocket expenses of $5,000. $50 Urgent Care copay and $3 and $25 Tier 1A and Tier 1B drug copays. $75 and $187.50 preferred brand drug copays. $10 copay for lab work. $75 copay for x-rays.

Oscar Gold Elite – $0 Ded Plan – $0 and $25 office visit copays. $0 deductible with maximum out-of-pocket expenses of $8,000. $50 Urgent Care copay and $3 and $10 Tier 1A and Tier 1B drug copays. $50 and $125 preferred brand drug copays. $25 copay for lab work. $75 copay for x-rays. $375 imaging copay.

UnitedHealthcare Gold Value+ – $20 (first three visits $0 copay) and $70 office visit copays. $2,600 deductible and 20% coinsurance with maximum out-of-pocket expenses of $8,000. $70 Urgent Care copay and $3/$15 and $20 Tier 1 and Tier 2 drug copays. $50 Tier 3 drug copay. $25 copay for lab work. $65 copay for x-rays.

UnitedHealthcare Gold Advantage+ – $10 (first three visits $0 copay) and $40 office visit copays. $1,000 deductible and 20% coinsurance with maximum out-of-pocket expenses of $7,250. $50 Urgent Care copay and $3/$15 and $20 Tier 1 and Tier 2 drug copays. $50 Tier 3 drug copay. $15 copay for lab work. $65 copay for x-rays. $250 imaging copay at free standing office.

UnitedHealthcare Gold Advantage+ Extra – $10 (first three visits $0 copay) and $40 office visit copays. $2,000 deductible and 20% coinsurance with maximum out-of-pocket expenses of $7,500. $50 Urgent Care copay and $3/$15 and $20 Tier 1 and Tier 2 drug copays. $50 Tier 3 drug copay. $15 copay for lab work. $65 copay for x-rays. $250 imaging copay at free standing office.

Current Arizona Health Insurance Rates

Maricopa County

Single Person Age 30 With $30,000 Income

$35 – Bright Health Bronze 8700

$36 – UnitedHealthcare Bronze Essential+

$39 – UnitedHealthcare Bronze Value+

$41 – Medica Pinnacle Bronze Value

$82 – UnitedHealthcare Silver-E Value Plus

Married Couple Age 30 With $40,000 Income

$12 – Bright Health Bronze 8700

$14 – UnitedHealthcare Bronze Essential+

$57 – UnitedHealthcare Bronze Value+

$63 – Medica Pinnacle Bronze Value

$105 – UnitedHealthcare Silver-E Value Plus

Married Couple Age 40 And One Child With $55,000 Income

$47 – Bright Health Bronze 8700

$49 – UnitedHealthcare Bronze Essential+

$57 – UnitedHealthcare Bronze Value+

$63 – Medica Pinnacle Bronze Value

$182 – UnitedHealthcare Silver Value Plus

Married Couple Age 40 And Two Children With $70,000 Income

$93 – Bright Health Bronze 8700

$96 – UnitedHealthcare Bronze Essential+

$106 – UnitedHealthcare Bronze Value+

$114 – Medica Pinnacle Bronze Value

$264 – UnitedHealthcare Silver Value Plus

Single Person Age 50 With $45,000 Income

$197 – Bright Health Bronze 8700

$199 – UnitedHealthcare Bronze Essential+

$203 – UnitedHealthcare Bronze Value+

$206 – Medica Pinnacle Bronze Value

$273 – UnitedHealthcare Silver Value Plus

Married Couple Age 50 With $55,000 Income

$145 – Bright Health Bronze 8700

$148 – UnitedHealthcare Bronze Essential+

$156 – UnitedHealthcare Bronze Value+

$163 – Medica Pinnacle Bronze Value

$291 – UnitedHealthcare Silver Value Plus

Single Person Age 60 With $40,000 Income

$97 – Bright Health Bronze 8700

$99 – UnitedHealthcare Bronze Essential+

$105 – UnitedHealthcare Bronze Value+

$110 – Medica Pinnacle Bronze Value

$207 – UnitedHealthcare Silver Value Plus

Married Couple Age 60 With $50,000 Income

$4 – Bright Health Bronze 8700

$8 – UnitedHealthcare Bronze Essential+

$20 – UnitedHealthcare Bronze Value+

$31 – Medica Pinnacle Bronze Value

$225 – UnitedHealthcare Silver Value Plus

Pima County

Single Person Age 30 With $30,000 Income

$24 – Bright Health Bronze 8700

$35 – Bright Health Bronze 7200

$45 – BCBS Blue AdvanceHealth Bronze

$47 – Bright Health Bronze 5300 HSA

$75 – Bright Health Silver 2000

Married Couple Age 30 With $40,000 Income

$0 – Bright Health Bronze 8700

$11 – Bright Health Bronze 7200

$30 – BCBS Blue AdvanceHealth Bronze

$34 – Bright Health Bronze 5300 HSA

$90 – Bright Health Silver 2000

Married Couple Age 40 And One Child With $55,000 Income

$12 – Bright Health Bronze 8700

$44 – Bright Health Bronze 7200

$73 – BCBS Blue AdvanceHealth Bronze

$78 – Bright Health Bronze 5300 HSA

$160 – Bright Health Silver 4000

Married Couple Age 40 And Two Children With $70,000 Income

$48 – Bright Health Bronze 8700

$90 – Bright Health Bronze 7200

$125 – BCBS Blue AdvanceHealth Bronze

$133 – Bright Health Bronze 5300 HSA

$236 – Bright Health Silver 4000

Single Person Age 50 With $45,000 Income

$179 – Bright Health Bronze 8700

$196 – Bright Health Bronze 7200

$211 – BCBS Blue AdvanceHealth Bronze

$214 – Bright Health Bronze 5300 HSA

$258 – Bright Health Silver 4000

Married Couple Age 50 With $55,000 Income

$108 – Bright Health Bronze 8700

$143 – Bright Health Bronze 7200

$211 – BCBS Blue AdvanceHealth Bronze

$173 – Bright Health Bronze 5300 HSA

$267 – Bright Health Silver 4000

Single Person Age 60 With $40,000 Income

$68 – Bright Health Bronze 8700

$95 – Bright Health Bronze 7200

$118 – BCBS Blue AdvanceHealth Bronze

$123 – Bright Health Bronze 5300 HSA

$189 – Bright Health Silver 4000

Married Couple Age 60 With $50,000 Income

$0 – Bright Health Bronze 8700

$1 – Bright Health Bronze 7200

$47 – BCBS Blue AdvanceHealth Bronze

$56 – Bright Health Bronze 5300 HSA

$189 – Bright Health Silver 4000

Arizona Senior Medicare Plans

Arizona Medicare Advantage Plans

Medicare Advantage (MA) plans are available in all counties. The counties that offer the most options are Maricopa (93), Pima (83), Pinal (78), Yavapai (41), Santa Cruz (41), and Gila (40). HSA plans are not offered to Seniors although accumulated funds may still be utilized for qualified expenses. Shown below are many of the most popular PPO and HMO plans.

AARP Medicare Advantage Patriot No Rx AZ-MA01 – $0 monthly premium with $4,300 maximum out-of-pocket expenses. Prescription drug benefits are not provided. The Plan Summary Star Rating is 4.0 with $0-$10 and $0-$40 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $30 copay and the outpatient x-ray copay is $25. The Urgent Care copay is $0-$40 and the outpatient hospital copay is $0-$395. Speech and language, physical, and occupational therapy copays are $0-$40. Foot exams are covered with a $40 copay.

AARP Medicare Advantage from UHC AZ-0002 – $0 monthly premium with $2,900 maximum out-of-pocket expenses. Prescription benefits include $0, $10, and $45 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.5 with $0 and $0-$20 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $40 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $0-$40 and the outpatient hospital copay is $0-$230. Speech and language, physical, and occupational therapy copays are $0-$20. Foot exams are covered with a $20 copay.

AARP Medicare Advantage from UHC AZ-0003 – $31 monthly premium with $2,500 maximum out-of-pocket expenses. Prescription benefits include $0, $8, and $45 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.5 with $0 and $0-$10 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $40 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $0-$40 and the outpatient hospital copay is $0-$145. Speech and language, physical, and occupational therapy copays are $0-$10. Foot exams are covered with a $10 copay.

AARP Medicare Advantage from UHC AZ-0005 – $0 monthly premium with $2,900 maximum out-of-pocket expenses. Prescription benefits include $0, $12, and $45 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.5 with $0 and $0-$30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $40 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $0-$40 and the outpatient hospital copay is $0-$295. Speech and language, physical, and occupational therapy copays are $0-$20. Foot exams are covered with a $30 copay.

AARP Medicare Advantage from UHC AZ-0006 – $0 monthly premium with $4,500 maximum out-of-pocket expenses. Prescription benefits include $0, $5, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.0 with $0 and $0-$30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $40 copay and the outpatient x-ray copay is $25. The Urgent Care copay is $0-$40 and the outpatient hospital copay is $0-$325. Speech and language, physical, and occupational therapy copays are $0-$30. Foot exams are covered with a $30 copay.

AARP Medicare Advantage Plan 3 – $30 monthly premium with $2,500 maximum out-of-pocket expenses. Prescription benefits include $0, $8, and $45 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.5 with $0 and $10 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $30 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$145. Speech and language, physical, and occupational therapy copays are $10. Foot exams are covered with a $10 copay.

AARP Medicare Advantage Plan 4 – $0 monthly premium with $2,900 maximum out-of-pocket expenses. Prescription benefits include $0, $12, and $45 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.5 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $30 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$250. Speech and language, physical, and occupational therapy copays are $20. Foot exams are covered with a $30 copay.

AARP Medicare Advantage Walgreens Plan 1 – $0 monthly premium with $4,500 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.0 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $30 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$275. Speech and language, physical, and occupational therapy copays are $30. Foot exams are covered with a $35 copay.

AARP Medicare Advantage Walgreens Plan 2 – $0 monthly premium with $5,400 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.0 with $0 and $35 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $30 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$300. Speech and language, physical, and occupational therapy copays are $25. Foot exams are covered with a $35 copay.

AARP Medicare Advantage Walgreens Plan 3 – $25 monthly premium with $3,500 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.0 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $30 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$250. Speech and language, physical, and occupational therapy copays are $20. Foot exams are covered with a $30 copay.

Aetna Medicare Eagle Plan – $0 monthly premium with $5,500 maximum out-of-pocket expenses. Prescription drug benefits are not provided. The Plan Summary Star Rating is 4.5 with $0 and $45 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$10 copay and the outpatient x-ray copay is $10. The Urgent Care copay is $50 and the outpatient hospital copay is $0-$275. Speech and language, physical, and occupational therapy copays are $20. Foot exams are covered with a $45 copay.

Aetna Medicare Platinum Plan – $85 monthly premium with $6,500 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $47 and copays for preferred generic, generic, and preferred brand drugs.. The Plan Summary Star Rating is 4.5 with $0 and $35 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$20 copay and the outpatient x-ray copay is $20. The Urgent Care copay is $50 and the outpatient hospital copay is $0-$240. Speech and language, physical, and occupational therapy copays are $35. Foot exams are covered with a $35 copay.

Aetna Medicare Freedom Plan – $0 monthly premium with $5,500 maximum out-of-pocket expenses. Prescription benefits include $0, $10, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.5 with $0 and $40 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$30 copay and the outpatient x-ray copay is $30. The Urgent Care copay is $50 and the outpatient hospital copay is $0-$275. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $40 copay.

Aetna Medicare Prime Plan – $0 monthly premium with $7,550 maximum out-of-pocket expenses. Prescription benefits include $0, $10, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.0 with $0 and $40 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$30 copay and the outpatient x-ray copay is $30. The Urgent Care copay is $65 and the outpatient hospital copay is $0-$330. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $40 copay.

Alignment Health Plan The ONE – $0 monthly premium with $2,499 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $40 copays for preferred generic, generic, and preferred brand drugs. $0 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $0 and the outpatient hospital copay is $85. Speech and language, physical, and occupational therapy copays are $0. Foot exams are covered with a $0 copay.

Amerivantage Plus – $0 monthly premium with $3,000 maximum out-of-pocket expenses. Prescription benefits include $0, $7.50, and $40 copays for preferred generic, generic, and preferred brand drugs. $0 and $20 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$30 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$175. Speech and language, physical, and occupational therapy copays are $15. Foot exams are covered with a $0 copay.

AVA – $0 monthly premium with $3,00 maximum out-of-pocket expenses. Prescription benefits include $0, $5, and $40 copays for preferred generic, generic, and preferred brand drugs. $5 and $20 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $20 and the outpatient hospital copay is $175. Speech and language, physical, and occupational therapy copays are $0. Foot exams are covered with a $0 copay.

Banner Medicare Advantage Plus – $25 monthly premium with $4,500 maximum out-of-pocket expenses. Prescription benefits include $0, $5, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 5.0 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $10 copay and the outpatient x-ray copay is $20. The Urgent Care copay is $30 and the outpatient hospital copay is $250. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $30 copay.

Banner Medicare Advantage Prime – $0 monthly premium with $2,775 maximum out-of-pocket expenses. Prescription benefits include $0, $5, and $47 copays for preferred generic, generic, and preferred brand drugs. $0 and $20 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$10 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $30 and the outpatient hospital copay is $175. Speech and language, physical, and occupational therapy copays are $25. Foot exams are covered with a $25 copay.

Blue Medicare Advantage Classic – $0 monthly premium with $4,250 maximum out-of-pocket expenses. Prescription benefits include $0, $9, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 5.0 with $0 and $45 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$75 copay and the outpatient x-ray copay is $20. The Urgent Care copay is $45 and the outpatient hospital copay is $25-$250. Speech and language, physical, and occupational therapy copays are $35. Foot exams are covered with a $45 copay.

Blue Medicare Advantage Plus – $48 monthly premium with $4,250 maximum out-of-pocket expenses. Prescription benefits include $0, $9, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.5 with $0 and $25 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$75 copay and the outpatient x-ray copay is $10. The Urgent Care copay is $25 and the outpatient hospital copay is $25-$225. Speech and language, physical, and occupational therapy copays are $20. Foot exams are covered with a $25 copay.

BlueJourney – $59 monthly premium with $5,000 maximum out-of-pocket expenses. Prescription benefits include $0, $9, and $47 copays for preferred generic, generic, and preferred brand drugs. $0 and $40 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$75 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $40 and the outpatient hospital copay is $25-$275. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $40 copay.

BluePathway Plan 1 – $0 monthly premium with $2,900 maximum out-of-pocket expenses. Prescription benefits include $0, $7, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.0 with $0 and $20 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$75 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $20 and the outpatient hospital copay is $25-$225. Speech and language, physical, and occupational therapy copays are $10. Foot exams are covered with a $20 copay.

BluePathway Plan 2 – $0 monthly premium with $2,900 maximum out-of-pocket expenses. Prescription benefits include $0, $7, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.0 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$75 copay and the outpatient x-ray copay is $10. The Urgent Care copay is $30 and the outpatient hospital copay is $25-$225. Speech and language, physical, and occupational therapy copays are $10. Foot exams are covered with a $30 copay.

Bright Advantage Classic Care Plan – $0 monthly premium with $2,800 maximum out-of-pocket expenses. Prescription benefits include $0, $5, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.5 with $0 and $10 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$100 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $0 and the outpatient hospital copay is $0-$200. Speech and language, physical, and occupational therapy copays are $10. Foot exams are covered with a $0 copay.

Bright Advantage Classic Choice Plan – $39.20 monthly premium with $3,200 maximum out-of-pocket expenses. Prescription benefits include $0, 25%, and 25% copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.5 with $0 and $15 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$200 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $0 and the outpatient hospital copay is $0-$225. Speech and language, physical, and occupational therapy copays are $20. Foot exams are covered with a $25 copay.

Cigna Preferred Medicare – $0 monthly premium with $2,900 maximum out-of-pocket expenses. Prescription benefits include $0, $4, and $42 copays for preferred generic, generic, and preferred brand drugs. $0 and $35 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$25 copay and the outpatient x-ray copay is $0-$25. The Urgent Care copay is $0-$25 and the outpatient hospital copay is $25-$295. Speech and language, physical, and occupational therapy copays are $35. Foot exams are covered with a $30 copay.

Cigna True Choice Medicare – $0 monthly premium with $4,100 maximum out-of-pocket expenses. Prescription benefits include $0, $4, and $42 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.5 with $0 and $45 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$50 copay and the outpatient x-ray copay is $10. The Urgent Care copay is $30 and the outpatient hospital copay is $0-$275. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $30 copay.

Clover Health Choice – $0 monthly premium with $3,400 maximum out-of-pocket expenses. Prescription benefits include $0, $10, and $37 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.5 with $0 and $15 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$150 copay and the outpatient x-ray copay is $30. The Urgent Care copay is $25 and the outpatient hospital copay is $150. Speech and language, physical, and occupational therapy copays are $15. Foot exams are covered with a $15 copay.

Essence Advantage – $0 monthly premium with $1,750 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $39 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 5.0 with $0 and $25 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a 0-20% copay and the outpatient x-ray copay is $20. The Urgent Care copay is $35 and the outpatient hospital copay is $250 or 20%. Speech and language, physical, and occupational therapy copays are $30. Foot exams are covered with a $25 copay.

Essence Advantage Plus – $66 monthly premium with $1,700 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $34 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 5.0 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a 0-20% copay and the outpatient x-ray copay is $20. The Urgent Care copay is $25 and the outpatient hospital copay is $150 or 20%. Speech and language, physical, and occupational therapy copays are $20. Foot exams are covered with a $30 copay.

Essence Advantage Select – $0 monthly premium with $2,800 maximum out-of-pocket expenses. Prescription benefits include $4, $15, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 5.0 with $0 and $35 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a 0-20% copay and the outpatient x-ray copay is $20. The Urgent Care copay is $35 and the outpatient hospital copay is $250 or 20%. Speech and language, physical, and occupational therapy copays are $35. Foot exams are covered with a $35 copay.

Global Classic – $0 monthly premium with $3,400 maximum out-of-pocket expenses. Prescription benefits include $5, $15, and $42 copays for preferred generic, generic, and preferred brand drugs. $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a 0-$100 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $65 and the outpatient hospital copay is $225. Speech and language, physical, and occupational therapy copays are $30. Foot exams are covered with a $30 copay.

Humana Gold Plus – $0 monthly premium with $2,900 maximum out-of-pocket expenses. Prescription benefits include $5, $10, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.5 with $0 and $35 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$35 copay and the outpatient x-ray copay is $0-$35. The Urgent Care copay is $0-$35 and the outpatient hospital copay is $35-$245. Speech and language, physical, and occupational therapy copays are $35. Foot exams are covered with a $35 copay.

Imperial Insurance Company Traditional – $0 monthly premium with $2,999 maximum out-of-pocket expenses. Prescription benefits include $5, $10, and $47 copays for preferred generic, generic, and preferred brand drugs. $0 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $0 and the outpatient hospital copay is $0. Speech and language, physical, and occupational therapy copays are $15. Foot exams are covered with a $0 copay.

SCAN Classic – $0 monthly premium with $2,800 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $37 copays for preferred generic, generic, and preferred brand drugs. $0 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $0 and the outpatient hospital copay is $0. Speech and language, physical, and occupational therapy copays are $10. Foot exams are covered with a $20 copay.

SCAN Venture – $0 monthly premium with $2,999 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $40 copays for preferred generic, generic, and preferred brand drugs. $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $20 and the outpatient hospital copay is $30-$250. Speech and language, physical, and occupational therapy copays are $30. Foot exams are covered with a $30 copay.

UnitedHealthcare Medicare Advantage Choice Plan 2 – $54 monthly premium with $6,700 maximum out-of-pocket expenses. Prescription benefits include $0, $5, and $45 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.0 with $10 and $50 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $20 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$370. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $50 copay.

UnitedHealthcare Medicare Advantage Choice Plan 3 – $19 monthly premium with $6,700 maximum out-of-pocket expenses. Prescription benefits include $4, $15, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 4.0 with $0 and $40 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $20 copay and the outpatient x-ray copay is $15. The Urgent Care copay is $40 and the outpatient hospital copay is $0-$325. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $40 copay.

Wellcare Assist – $31.90 monthly premium with $3,100 maximum out-of-pocket expenses. Prescription benefits include $0, $20, and $47 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 3.0 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$35 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $45 and the outpatient hospital copay is $225. Speech and language, physical, and occupational therapy copays are $40. Foot exams are covered with a $30 copay.

Wellcare Community Assist – $33.40 monthly premium with $5,000maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $37 copays for preferred generic, generic, and preferred brand drugs. The Plan Summary Star Rating is 5.0 with $0 and $30 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$30 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $30 and the outpatient hospital copay is $325. Speech and language, physical, and occupational therapy copays are $30. Foot exams are covered with a $30 copay.

Wellcare No Premium Open – $0 monthly premium with $3,900 maximum out-of-pocket expenses. Prescription benefits include $0, $0, and $37 copays for preferred generic, generic, and preferred brand drugs. $0 and $35 (pcp and specialist) office visit copays. Diagnostic tests and procedures have a $0-$50 copay and the outpatient x-ray copay is $0. The Urgent Care copay is $25 and the outpatient hospital copay is $250. Speech and language, physical, and occupational therapy copays are $35. Foot exams are covered with a $35 copay.

Arizona Part D Prescription Drug Plans

A total of 28 plans are offered, including 11 plans that qualify for the Senior Savings model that provides lower out-of-pocket costs for insulin. The range of monthly cost for all plans is $5.40 to $166.20. Five plans cost less than $25 per month, and six plans feature a $0 deductible. The average cost of coverage for all plans is $53.94 and four plans have gap coverage. Extra Help is available to help further reduce plans costs for qualified applicants. Plans are listed below in alphabetical order.

AARP MedicareRx Preferred – $0 deductible with 3,673 available forumary drugs and a monthly premium of $110.80. 43,597 members are enrolled in Arizona and 1,427,040 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $7 (Tier 1 Preferred Generic), $12 (Tier 2 Generic), $47 (Tier 3 Preferred Brand), 40% (Tier 4 Non-Preferred Drug) and 33% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $0 (Tier 2 Generic), $126 (Tier 3 Preferred Brand), 40% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty). Additional gap coverage offered.

AARP MedicareRx Saver Plus – $505 deductible with 3,209 available formulary drugs and a monthly premium of $37.30. 15,972 members are enrolled in Arizona and 787,950 members are enrolled nationally. The plan summary star rating is 3.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $14 (Tier 2 Generic), 17% (Tier 3 Preferred Brand), 42% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $42 (Tier 2 Generic), 17% (Tier 3 Preferred Brand), 42% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty). No additional gap coverage offered.

AARP MedicareRx Walgreens – $350 deductible with 3,288 available formulary drugs and a monthly premium of $28.20. 33,809 members are enrolled in Arizona and 843,981 members are enrolled nationally. The plan summary star rating is 3.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $10 (Tier 2 Generic), $40 (Tier 3 Preferred Brand), 45% (Tier 4 Non-Preferred Drug) and 27% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $30 (Tier 2 Generic), $120 (Tier 3 Preferred Brand), 45% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty). No additional gap coverage offered.

Amerivantage Rx Basic – $460 deductible with 2,946 available formulary drugs and a monthly premium of $59.20. 159 members are enrolled in Arizona and 504 members are enrolled nationally. The plan summary star rating is 2.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $5 (Tier 2 Generic), 22% (Tier 3 Preferred Brand), 38% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $15 (Tier 2 Generic), 22% (Tier 3 Preferred Brand), 38% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Amerivantage Rx Plus – $0 deductible with 3,148 available formulary drugs and a monthly premium of $66.70. 1,434 members are enrolled in Arizona and 3,901 members are enrolled nationally. The plan summary star rating is 2.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $3 (Tier 2 Generic), $47 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and 33% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $9 (Tier 2 Generic), $141 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Banner Medicare Classic – $480 deductible with 3,523 available formulary drugs and a monthly premium of $39.30. Less than 10 members are enrolled in Arizona and less than 10 members are enrolled nationally. The plan has no summary star rating yet. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $6 (Tier 2 Generic), $40 (Tier 3 Preferred Brand), 37% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $12 (Tier 2 Generic), $80 (Tier 3 Preferred Brand), 37% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Banner Medicare Premier – $0 deductible with 3,523 available formulary drugs and a monthly premium of $85.40. Less than 10 members are enrolled in Arizona and less than 10 members are enrolled nationally. The plan has no summary star rating yet. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $4 (Tier 2 Generic), $40 (Tier 3 Preferred Brand), 39% (Tier 4 Non-Preferred Drug) and 33% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $8 (Tier 2 Generic), $80 (Tier 3 Preferred Brand), 39% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Banner Medicare Simple – $480 deductible with 3,255 available formulary drugs and a monthly premium of $37.40. Less than 10 members are enrolled in Arizona and less than 10 members are enrolled nationally. The plan has no summary star rating yet. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $11 (Tier 2 Generic), 22% (Tier 3 Preferred Brand), 38% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $22 (Tier 2 Generic), 22% (Tier 3 Preferred Brand), 38% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Blue MedicareRx Enhanced – $0 deductible with 2,867 available formulary drugs and a monthly premium of $139.30. 976 members are enrolled in Arizona and 976 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $3 (Tier 2 Generic), 20% (Tier 3 Preferred Brand), 45% (Tier 4 Non-Preferred Drug) and 33% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $7.50 (Tier 2 Generic), 20% (Tier 3 Preferred Brand), 45% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Blue MedicareRx Value – $480 deductible with 2,867 available formulary drugs and a monthly premium of $36.20. 21,248 members are enrolled in Arizona and 33,046 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $3 (Tier 2 Generic), 25% (Tier 3 Preferred Brand), 36% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $9 (Tier 2 Generic), 25% (Tier 3 Preferred Brand), 36% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Cigna Essential Rx – $480 deductible with 3,170 available formulary drugs and a monthly premium of $34.80. 4,442 members are enrolled in Arizona and 206,697 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $6 (Tier 2 Generic), 18% (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $18 (Tier 2 Generic), 18% (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Cigna Extra Rx – $100 deductible with 3,271 available formulary drugs and a monthly premium of $69.50. 6,544 members are enrolled in Arizona and 334,151 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $4 (Tier 1 Preferred Generic), $10 (Tier 2 Generic), $42 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and 31% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $4 (Tier 2 Generic), $126 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Cigna Secure Rx – $480 deductible with 3,190 available formulary drugs and a monthly premium of $36.30. 14,491 members are enrolled in Arizona and 868,540 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $2 (Tier 1 Preferred Generic), $17 (Tier 2 Generic), $47 (Tier 3 Preferred Brand), 41% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $0 (Tier 2 Generic), $141 (Tier 3 Preferred Brand), 41% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Clear Spring Health Premier Rx – $480 deductible with 3,160 available formulary drugs and a monthly premium of $29.10. 953 members are enrolled in Arizona and 138,188 members are enrolled nationally. The plan summary star rating is 2.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $5 (Tier 2 Generic), $42 (Tier 3 Preferred Brand), 45% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $15 (Tier 2 Generic), $126 (Tier 3 Preferred Brand), 45% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty).

Clear Spring Health Value Rx – $480 deductible with 3,147 available formulary drugs and a monthly premium of $33.20. 2,401 members are enrolled in Arizona and 160,530 members are enrolled nationally. The plan summary star rating is 2.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $3 (Tier 2 Generic), $42 (Tier 3 Preferred Brand), 38% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $9 (Tier 2 Generic), $126 (Tier 3 Preferred Brand), 38% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty).

Elixir Rx Secure – $480 deductible with 3,085 available formulary drugs and a monthly premium of $38.60. 7,910 members are enrolled in Arizona and 461,036 members are enrolled nationally. The plan summary star rating is 3.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $4 (Tier 2 Generic), 15% (Tier 3 Preferred Brand), 30% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $6 (Tier 2 Generic), 15% (Tier 3 Preferred Brand), 30% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Humana Basic Rx Plan – $480 deductible with 3,104 available formulary drugs and a monthly premium of $38.20. 17,460 members are enrolled in Arizona and 1,261,875 members are enrolled nationally. The plan summary star rating is 4.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $1 (Tier 2 Generic), 19% (Tier 3 Preferred Brand), 39% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $0 (Tier 2 Generic), 15% (Tier 3 Preferred Brand), 30% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Humana Premier Rx Plan – $480 deductible with 3,281 available formulary drugs and a monthly premium of $76.80. 21,203 members are enrolled in Arizona and 954,953 members are enrolled nationally. The plan summary star rating is 4.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $4 (Tier 2 Generic), $45 (Tier 3 Preferred Brand), 49% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $0 (Tier 2 Generic), $125 (Tier 3 Preferred Brand), 49% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Humana Walmart Value Rx Plan – $480 deductible with 3,221 available formulary drugs and a monthly premium of $22.70. 32,901 members are enrolled in Arizona and 1,252,333 members are enrolled nationally. The plan summary star rating is 4.0. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $4 (Tier 2 Generic), 18% (Tier 3 Preferred Brand), 41% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $12 (Tier 2 Generic), 18% (Tier 3 Preferred Brand), 41% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Mutual Of Omaha Rx Plus – $480 deductible with 2,970 available formulary drugs and a monthly premium of $105.10. 405 members are enrolled in Arizona and 19,079 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $3 (Tier 2 Generic), 19% (Tier 3 Preferred Brand), 42% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $9 (Tier 2 Generic), 19% (Tier 3 Preferred Brand), n/a (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Mutual Of Omaha Rx Premier – $480 deductible with 2,970 available formulary drugs and a monthly premium of $105.10. 405 members are enrolled in Arizona and 19,079 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $3 (Tier 2 Generic), 19% (Tier 3 Preferred Brand), 42% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $9 (Tier 2 Generic), 19% (Tier 3 Preferred Brand), n/a (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

SilverScript Choice – $480 deductible with 3,108 available formulary drugs and a monthly premium of $33.10. 35,507 members are enrolled in Arizona and 3,214,280 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $6 (Tier 2 Generic), 17% (Tier 3 Preferred Brand), 41% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $18 (Tier 2 Generic), 17% (Tier 3 Preferred Brand), 41% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

SilverScript Plus – $0 deductible with 3,278 available formulary drugs and a monthly premium of $84.70. 2,545 members are enrolled in Arizona and 235,531 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $2 (Tier 2 Generic), $47 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and 33% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $0 (Tier 2 Generic), $120 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

SilverScript SmartRx – $480 deductible with 3,601 available formulary drugs and a monthly premium of $7.50. 41,005 members are enrolled in Arizona and 1,201,863 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $1 (Tier 1 Preferred Generic), $19 (Tier 2 Generic), $46 (Tier 3 Preferred Brand), 49% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $3 (Tier 1 Preferred Generic), $57 (Tier 2 Generic), $138 (Tier 3 Preferred Brand), 49% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Wellcare Classic – $480 deductible with 3,110 available formulary drugs and a monthly premium of $32.80. 19,006 members are enrolled in Arizona and 1,473,307 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $6 (Tier 2 Generic), $40 (Tier 3 Preferred Brand), 49% (Tier 4 Non-Preferred Drug) and 25% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $1 8(Tier 2 Generic), $120 (Tier 3 Preferred Brand), 40% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Wellcare Medicare Rx Value Plus – $0 deductible with 3,464 available formulary drugs and a monthly premium of $59.00. 28,834 members are enrolled in Arizona and 577,317 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $4 (Tier 2 Generic), $47 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and 33% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $10 (Tier 2 Generic), $117.50 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

Wellcare Value Script – $480 deductible with 3,450 available formulary drugs and a monthly premium of $13.00. 44,976 members are enrolled in Arizona and 2,110,703 members are enrolled nationally. The plan summary star rating is 3.5. The 30-day supply cost-sharing copays (preferred pharmacy) are $0 (Tier 1 Preferred Generic), $4 (Tier 2 Generic), $47 (Tier 3 Preferred Brand), 50% (Tier 4 Non-Preferred Drug) and 33% (Tier 5 Specialty). The 90-day supply cost-sharing copays (90-day mail order) are $0 (Tier 1 Preferred Generic), $12 (Tier 2 Generic), $126 (Tier 3 Preferred Brand), 47% (Tier 4 Non-Preferred Drug) and n/a (Tier 5 Specialty).

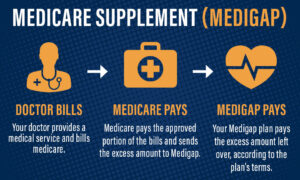

Arizona Medicare Supplement Rates

2023 Rates are monthly and are based on a 65-year-old female residing in Pima County. Household and non-smoker discounts (if available) have been applied. Prices and plan availability in other counties may differ.

Plan A

$82 – AARP-UnitedHealthcare

$95 – Amerigroup

$104 – Elips Life

$105 – United States Fire

$109 – Mutual Of Omaha

$110 – Humana

$110 – Accendo

$112 – National Health

$113 – Great Southern Life

$113 – Aetna

$113 – Medico

$115 – Capitol Life

$118 – New Era Life

$122 – Union Security

$125 – Manhattan Life

$145 – GPM Health

$153 – United American

$191 – Cigna

$223 – Oxford Life

Plan B

$121 – AARP-UnitedHealthcare

$124 – United States Fire

$129 – Aetna

$167 – Humana

$217 – United American

$243 – Sentinel Security

Plan C

$134 – New Era Life

$139 – AARP-UnitedHealthcare

$210 – Humana

$294 – United American

Plan D

$162 – Central States

$231 – Sentinel Security

$290 – United American

Plan F

$124 – Elips Life

$125 – United States Fire

$128 – Medico

$135 – Humana

$137 – SBLI USA Life

$138 – Banker’s Fidelity

$138 – Accendo

$139 – Capitol Life

$140 – AARP-UnitedHealthcare

$140 – Manhattan Life

$141 – Great Southern Life

$143 – Amerigroup

$143 – Mutual Of Omaha

$143 – Aetna

$145 – National Health

$146 – Central States

$155 – New Era Life

$199 – Guarantee Trust Life

$217 – GPM Health

$231 – Cigna

$243 – Oxford Life

$255 – United American

Plan F (HD)

$38 – Medico

$38 – New Era Life

$41 – Great Southern Life

$43 – Humana

$45 – National Health

$45 – United American

$50 – Cigna

Plan G

$104 – United States Fire

$105 – AARP-UnitedHealthcare

$105 – Elips Life

$106 – Medico

$110 – Amerigroup

$113 – Mutual Of Omaha

$113 – Accendo

$113 – Humana

$116 – Capitol Life

$117 – Aetna

$118 – Manhattan Life

$119 – SBLI USA Life

$119 – New Era Life

$120 – Great Southern Life

$121 – Union Security

$123 – Bankers Fidelity

$141 – United American

$160 – Guarantee Trust Life

$171 – Oxford Life

$187 – Cigna

Plan G (HD)

$36 – Medico

$38 – New Era Life

$38 – United States Fire

$39 – Bankers Fidelity

$39 – Humana

$42 – Elips Life

$42 – Mutual Of Omaha

$44 – Aetna

$45 – United American

Plan K

$34 – AARP-UnitedHealthcare

$50 – United States Fire

$63 – Humana

$66 – Bankers Fidelity

$90 – Humana

$127 – United American

Plan L

$62 – United States Fire

$72 – AARP-UnitedHealthcare

$129 – Humana

$179 – United American

Plan N

$76 – AARP-UnitedHealthcare

$78 – United States Fire

$79 – Elips Life

$79 – GPM Health

$80 – AARP-UnitedHealthcare

$82 – Medico

$83 – Union Security

$84 – Accendo

$84 – Capitol Life

$84 – Aetna

$86 – Mutual Of Omaha

$87 – SBLI USA Life

$87 – New Era Life

$89 – Manhattan Life

$89 – Great Southern Life

$89 – National Health

$91 – Bankers Fidelity

$92 – Humana

$92 – Amerigroup

$106 – Central States

$127 – Guarantee Trust Life

$129 – Cigna

$163 – Sentinel Security

$199 – Oxford Life

$242 – United American